Cost Of Goods Sold: What It Is & How To Calculate It

If you’re selling online, you must closely track and monitor your Cost Of Goods Sold (COGS), one of the business’ crucial metrics that best reflect your store performance. But what is COGS and what makes it so important?

In this article, I will give you a full view of What COGS is; Why you need to track it, and How to accurately calculate your COGS.

What is Cost of Goods Sold?

The Cost of Goods Sold (or COGS) is the total cost of manufacturing your business’ products or services, which contains all the costs for materials and labor as well.

Since COGS is associated with production expenses only, it does not include marketing and distribution costs.

Here are some examples of costs that COGS generally includes:

- Raw materials

- Purchased items for resale

- Purchase returns and allowances

- Trade or cash discounts

- Factory labor

- Factory overhead

- Parts for production

- Storage costs

- Freight-in costs

Why do you need to track COGS for your business?

The Cost of Goods Sold shows your gross profit when deducted from its revenue. Therefore, it is considered a profitability measure to evaluate how efficiently you’re managing your business.

Since COGS directly affects your gross profit, you need to keep your COGS low to increase your net profit.

How to calculate Cost of Goods Sold?

Now that you know what COGS is and how important it is to your business, let me show you how to calculate it:

COGS = Beginning Inventory + Purchases – Ending Inventory

For those of you who are not yet familiar with the terms above:

- Beginning inventory: This is the value of products and raw materials that are in stock at the beginning of the reporting period.

- Ending inventory: It is the number of materials and products at the end of the reporting period.

- Purchases: They include all of the components, raw materials, and sold to other parties during this period.

NOTE: Since COGS directly relates to your gross profit, and of course, net profit, it’s important that you keep track of your COGS frequently to spot abnormal ups and downs and make timely adjustments.

You can create your own Sheet files or download COGS templates on the Internet.

However, you may have to spend hours gathering data and manually editing your files to keep your COGS accurate, which might be time-consuming.

So, to keep track of your COGS, revenues, profits & losses fast and accurately, perhaps you may need a profit-tracking app like TrueProfit, which automatically updates your COGS in real time.

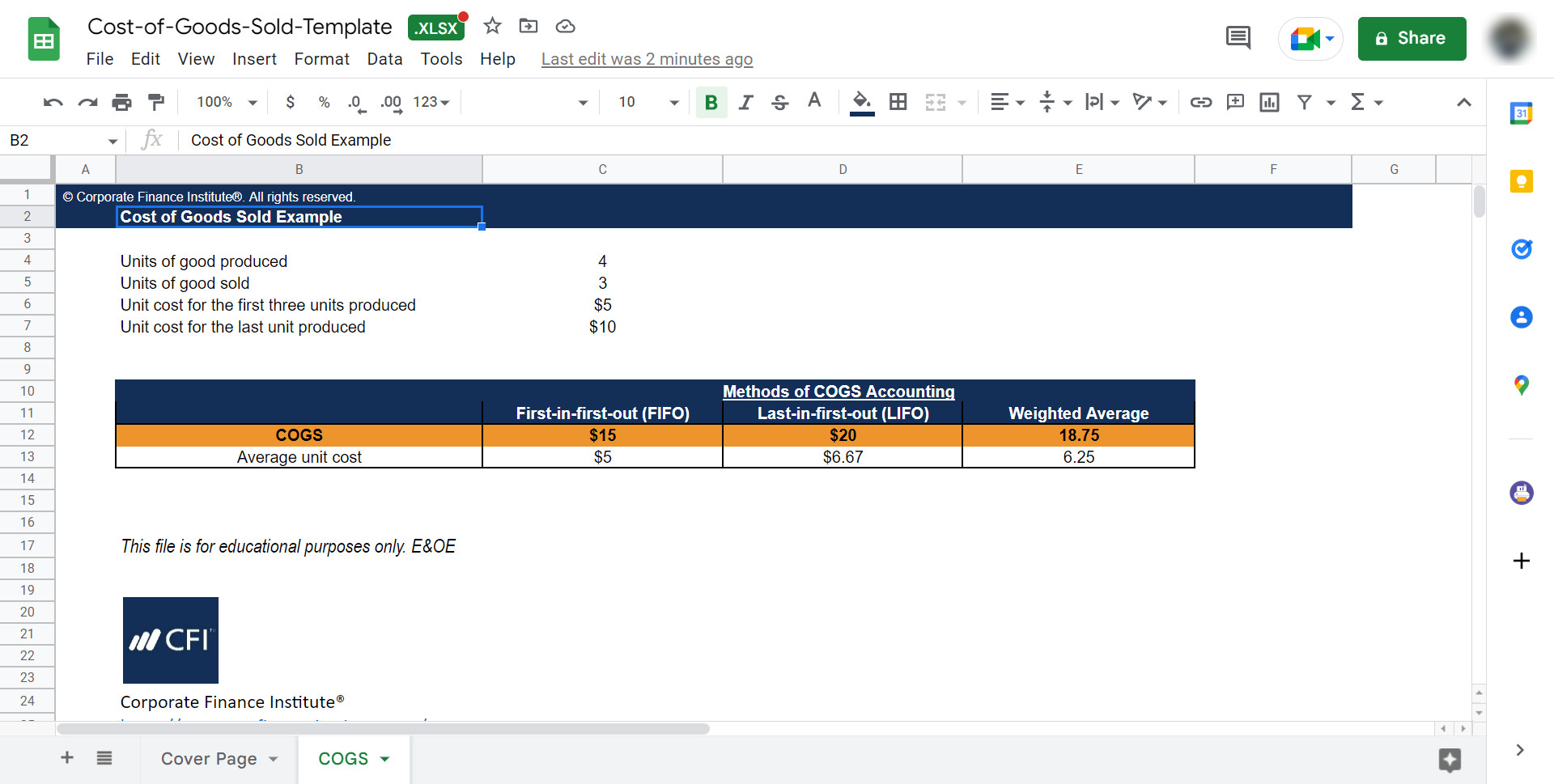

4 accounting methods for COGS

There are many methods to value your inventory, and different accounting methods for the Cost of Goods Sold yield different inventory values.

1. FIFO – First In, First Out method

To simply explain, the earliest products you make or purchase are the ones you sell first.

As prices tend to rise over time, you can use FIFO method to sell your least expensive products first, leading to a lower COGS than the one recorded under the LIFO method (which I’ll cover right after this).

Therefore, your net income will increase over time if you adopt the FIFO method.

2. LIFO – Last In, First Out method

LIFO, on the opposite, refers to selling the last goods that were made or purchased.

As I mentioned, prices tend to rise over time, the latest products you made or purchased are the most expensive. So when you distribute these products first, it will result in a higher COGS and a lower net income in return.

3. The Average Cost method

This accounting method values inventory that uses an average cost for the period. Moreover, it blends the cost throughout the period and smooths out price fluctuations.

4. The Specific Identification method

With this accounting method, you use the specific cost of each unit of the inventory or goods to calculate the inventory and Cost of Goods Sold for each period. So, you know exactly which item was sold and at what cost in this method.

Additionally, you will find this Specific Identification Method used in industries that sell unique items such as cars, real estate, and jewelry.

Compare the Cost of Goods Sold to other metrics

Many of you may think that Cost of Revenue and Operating Expenses are just other names of COGS. But actually, they are not.

1. COGS vs Cost of Revenue

First of all, the Cost of Revenue relates to the total cost of manufacturing and delivering a product or service to your consumers. It includes raw materials, direct labor, commission paid to your employees, and shipping costs.

However, the Cost of Revenue is different from COGS because it also includes the cost outside your production like marketing and distribution.

It should be noted that if you make a profit out of providing 100% services, you have to list your costs as Cost of Revenue, instead of COGS.

Still, if you’re a service-based business but you have products to sell, you can consider COGS in your income statements. For example, hotels and airlines primarily provide services such as lodging and transportation. They also sell food, beverage, gifts, and many other items. These are undoubtedly considered goods.

So be confident to list COGS on their income statement and claim tax purposes if you fall into one of the categories above.

2. COGS vs Operating Expenses

Though Operating Expenses and Cost of Goods Sold are similar because they’re both costs arising when you’re running your business, they’re different metrics on the income statement.

Unlike the Cost of Goods Sold, Operating Expenses are expenditures that don’t link directly to your goods or services production costs.

Selling, general, and administrative expenses (or SG&A) belong to operating expenses as a separate line item. Moreover, there are also other examples, including:

- Legal costs

- Office supplies

- Rent

- Utilities

- Payroll

- Sales and marketing

- Insurance costs

Final thoughts

And that’s it! Cost of Goods Sold is undoubtedly one of the most important metrics that you need to track since it directly affects your gross profit and tells you whether it’s possible for you to make a profit or not.